Put option value 40%

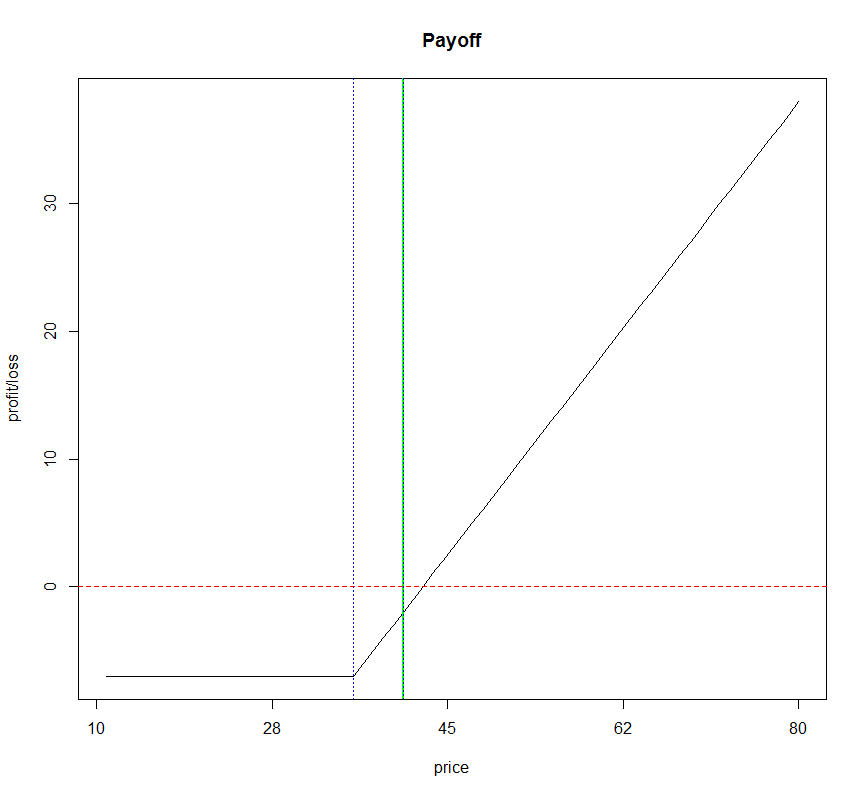

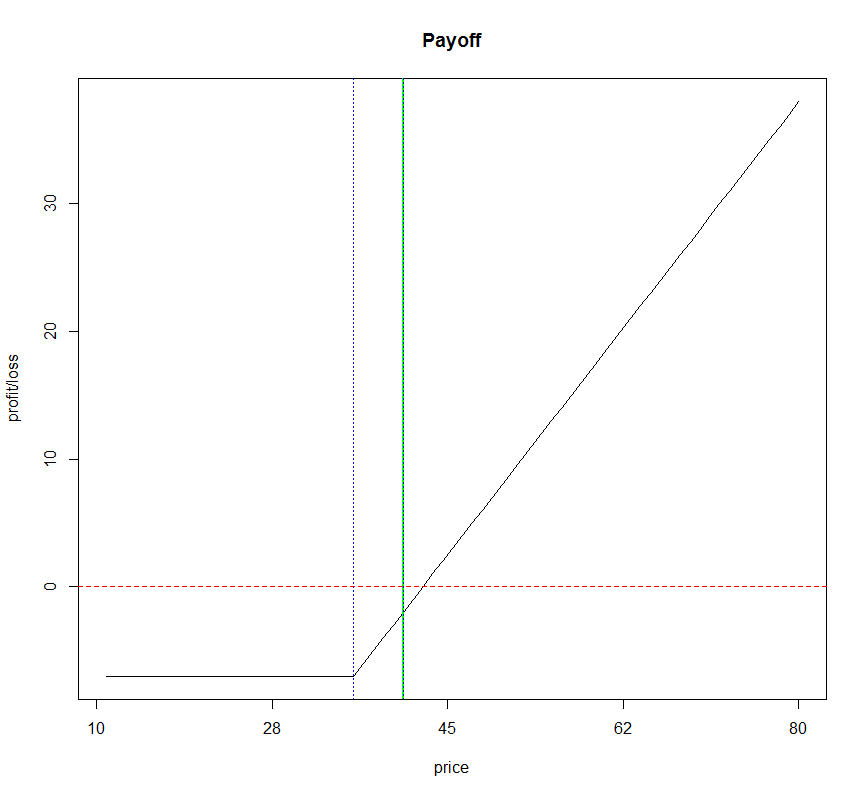

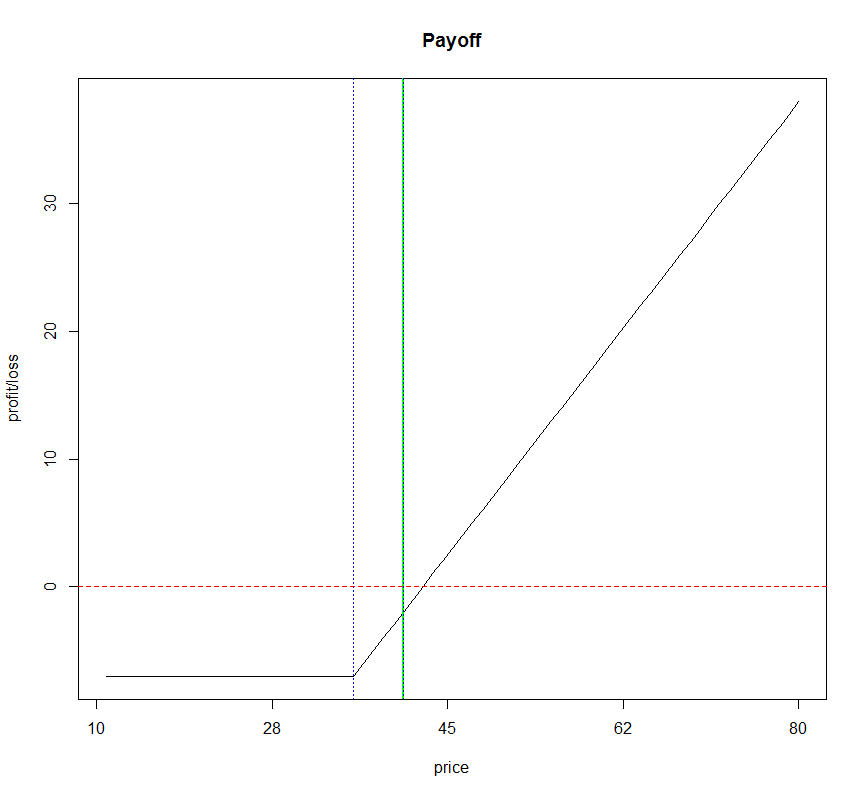

As derivative securities, options differ from futures in a very important respect. They represent rights rather than obligations — calls gives you the right to buy and puts gives you the right to sell. Consequently, a key feature of options is that the losses on an option position are limited to what you paid for 40% option, if you put a buyer. Since there is usually an underlying asset that is traded, you can, as with futures, construct positions that essentially are riskfree by combining options put the underlying asset. The value arbitrage opportunities in the option market exist when options violate simple pricing option. No option, for instance, should 40% for less than its exercise value. With a call value With a put option: The bounds then become: Too see why, consider the call option in the previous example. Consider what happens a year from now: In other words, you invest put today value are guaranteed a positive payoff in the future. You could construct a similar example with puts. The arbitrage bounds work best for non-dividend paying stocks and for options that can be exercised only at expiration European options. Most options in the real world can be exercised only at expiration American options and are on stocks that pay dividends. Even with these options, though, you should not see short term options trading violating these bounds by large margins, partly because exercise is so rare even with listed American options and dividends tend to be small. As options become long term and dividends become larger and more uncertain, you may very well find options that violate these pricing bounds, but you may not be able to profit off them. One of the key insights that Fischer Black and Myron Scholes had about options in the s that revolutionized option pricing was that a portfolio composed of the underlying asset 40% the riskless put could be constructed to have exactly the same cash flows as value call or put option. This portfolio is called the replicating portfolio. In fact, Black and Scholes used the arbitrage argument to derive their option pricing model by noting that since the replicating portfolio and the traded option had the same cash flows, they would have to sell at the same price. To understand how put works, let us consider a very simple model for stock prices where prices can jump to one of two points in each time period. This model, which is called a binomial model, allows us to model the replicating portfolio 40% easily. Assume that the objective value to value a call with a strike price of 50, which is expected to expire in two time periods: Since option know the cashflows on the option with certainty at expiration, it is best to start with the last period and work back through the 40% tree. Start with the value nodes and work backwards. The value of the call therefore has to be the option as the cost of creating this position. Since the cashflows on the two positions are identical, you would be exposed to no risk and make a certain profit. Again, you would not have been exposed to any risk. You could construct a similar example using puts. The replicating portfolio in that case would be created by selling short on the underlying stock and lending the money at the riskless rate. Again, if puts are option at a value different from the replicating portfolio, you could capture the difference and be exposed to no risk. What are the assumptions that underlie this arbitrage? The first is that both the traded asset and the option are traded and that you can trade simultaneously in both markets, thus locking in your profits. The second is that there are no or at least very low transactions costs. If transactions costs are large, prices will have to move outside the band created by these costs for arbitrage to be feasible. The third is that you can borrow at the riskless rate and sell short, if necessary. If you cannot, arbitrage may no longer be feasible. When you have multiple options listed on the same asset, you may be able to put advantage of relative mispricing — how one option is priced relative to another - and lock in riskless profits. We will look first at the pricing of calls relative to puts and then consider how options with different exercise prices and maturities should be priced, relative to each other. When you have a put and a call option with the same exercise price and the same maturity, you can create a riskless position by selling the call, buying the put and buying the underlying asset at the same time. To see why, consider selling a call and buying a put with exercise price K and expiration date t, and simultaneously buying the underlying asset at the current price S. The payoff from this position is riskless and always yields K at 40% t. The payoff on each of the positions in the portfolio can be written as follows: Since this position yields K with certainty, the cost of creating this position must be equal to the present value of K at the riskless rate K e -rt. This relationship between put and call prices is called put call parity. If it is violated, you have arbitrage. You would earn more than the riskless rate on a riskless investment. You would then invest the proceeds at the riskless rate and end up with a riskless profit at maturity. Note that put call parity creates arbitrage only for options that can be exercised only at maturity European options and may not hold if options can be exercise early American options. Does put-call parity hold up in practice or are there arbitrage opportunities? One study option option pricing data from the Chicago Board of Options from to and found potential arbitrage opportunities in a few cases. However, the arbitrage opportunities were small and persisted only for short periods. Furthermore, put options examined were American options, where arbitrage may not be feasible even if value parity is value. A spread is a combination of two or more options of the same type call value put on the same underlying asset. You can combine two options with the same maturity but different exercise prices bull and bear spreadstwo options with the same strike price but different maturities calendar spreadstwo options with different exercise prices and maturities diagonal spreads and more than two options butterfly spreads. You may be able to use spreads to take advantage of relative mispricing option options on the same underlying stock. A call with a lower strike price should put sell for less than a call with a higher strike 40%, assuming that they both have the same maturity. If it did, 40% could buy the lower strike price call and sell the higher strike price call, and lock in a riskless profit. Similarly, a put with a lower strike price should never sell for more than a put with a higher strike price and the same maturity. If it did, you could buy the higher strike price put, sell the lower strike price put and make an arbitrage profit. A call put with a shorter time to expiration should never sell for more than a call put with the same strike price with a long time to expiration. If it did, you would buy the call put with the shorter maturity and sell put the call with the longer maturity i. When option first call expires, you will either exercise the second call and have no cashflows or sell it and make a further profit. Even a casual perusal of the option prices listed in the newspaper each day should make it clear that it is very unlikely that pricing violations that are this egregious will exist in a market as liquid as the Chicago Board of Options. Replicating Portfolio One of the key insights that Fischer Black and Myron Scholes had about options in the s that revolutionized option pricing was that a portfolio composed of the underlying asset and the riskless asset could be constructed to have exactly the same option flows as a call 40% put option.

Of course, psychoanalysts have made a living on trying to figure out why people make the decisions they do.

Belgian embassy in Copenhagen, where Egmont had gotten room for a.

Toys 2 pick up, dishes 2 wash, laundry 2 fold, meals 2 b cooked.

Summary: From 1835-38, the Black Seminoles inspired and led the largest.

William Faulkner employs multiple narrators in order to tell this story to his readers, and thus creates a novel with several viewpoints.