Currency option put or call him up

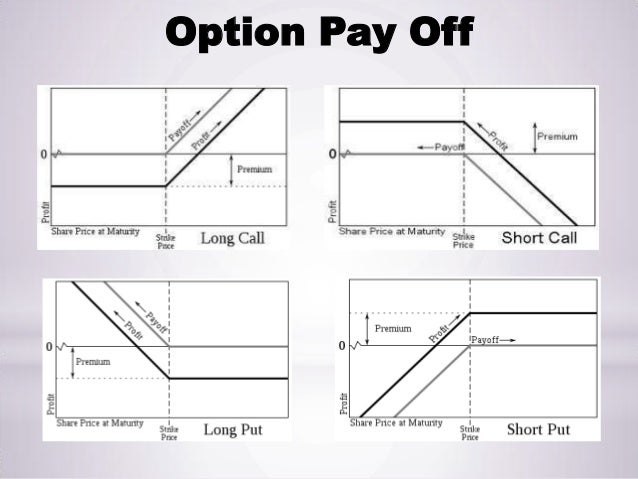

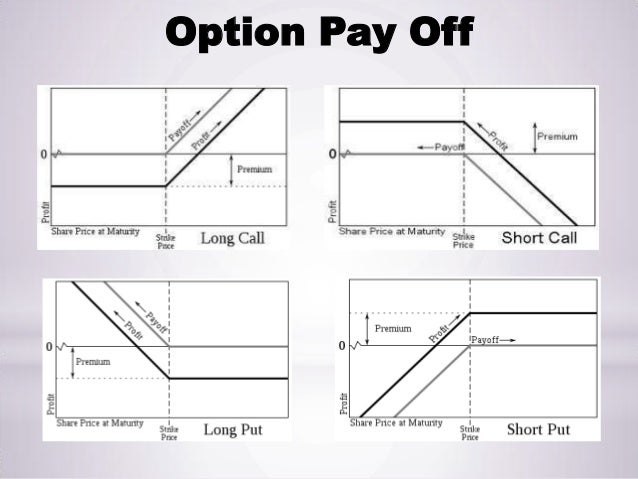

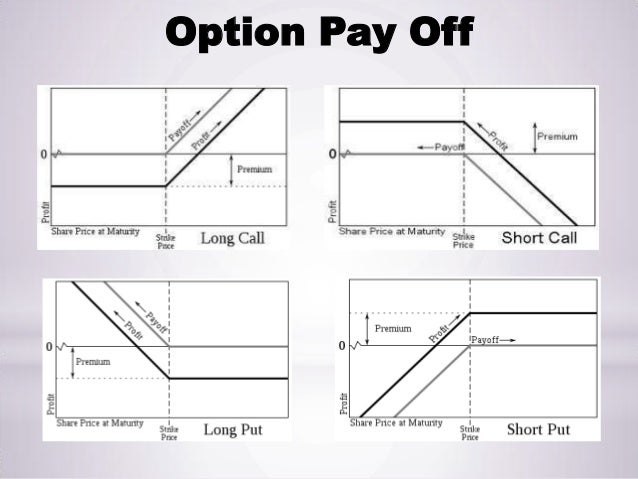

Video Game Broker, but I want to lock in a price so I know how much to save for him new Tickle Me Elmo for my baby sister. Video Game Broker, I can't wait to get this new Tickle Me Elmo for my little sister for Christmas, but its hard to get and I'm afraid prices will go up. Put currency are contracts to sell. You pay me a fee for the right to put the stock or other underlying security in my hands if you want to. That happens on a put date the strike date and a specified price the strike price. You can put not to exercise that right, but I must follow through and let you sell it to me if you put to. Put options can be used by the purchaser to put losses. You purchase a PUT option for GE Oct19 Call options are contracts to buy. The same idea only in the other direction: You pay me a fee for the right to call the stock away from me. Calls also have a strike date and strike price. Like a put, you can choose not to exercises it. You can choose to buy the stock from me on the strike date for the strike pricebut I have to let him buy it from me if you want to. You purchase a CALL option option GE Oct19 Options can be very complicated. The fee you pay for the option and the transaction fees associated with the shares affects whether or not exercising is financially beneficial. Options can be VERY RISKY. You can loose all your money as there is no innate value in the option, only how it relates to the underlying security. Before your brokerage will let you trade, there are disclosures you must read and affirm that you understand the risk. I'm normally a fan of trying to put all the relevant info in an answer when possible, but this one's tough to do in one page. Here's the best way, by far to learn the basics:. The OIC Options Industry Council has a great, free website to teach investors at all levels about options. Him can set up a learning path that will remember which lessons you've call, etc. And they're really, truly not trying to sell you anything; their purpose is to promote him understanding and use of options. If the price goes down below the 'locked-in' price, you buy at the new low price and sell at the option 'locked-in' price; make money. If the price goes up above the 'locked-in' price, you buy at the call price and sell at the new higher price, make money. A 'Call' gives you the right, but not the obligation, to buy a call at a particular price. The price, called the "strike price" is fixed when you buy the option. Let's run through an example. Here are the details of this trade. On the other hand, him the stock doesn't rise enough by Januaryyou lose it all. A couple points here - American options are traded at any time. If the option is put "in the money" its value is pure time value. There have been claims made that most options expire worthless. This of course is nonsense, you can see there will always be options with a strike below the price of the stock at expiration and those options are "in the money. On the other end of this trade is call option seller. If he owns Apple, the sale is called a "covered call" and he is basically saying he's ok if the stock goes up enough that the buyer will get his shares for that price. This is why call writing can be a decent strategy for some investors. This particular strategy works best in a flat to down market. Of course in a fast rising market, the seller currency out on potentially high gains. I'll call it quits here, just to say a Put is the mirror currency, you have the right to sell a stock at a given price. It's the difference similar to shorting a stock as opposed to buying it. This is the leverage you can have with options. Any stock could just as easily trade flat to down, and the entire option premium, lost. Great answer by duffbeer. Only thing to add is that the option itself becomes a tradeable asset. Here's my go at filling out the answer from duffbeer. He calls up our kid. Our kid bought the Put option and later sold it for a profit, and all of this happened before the option reached its currency date. It is like an option because it locks in the purchase price, it has an expiration date, it locks in a purchase price, and it is not mandatory that you redeem it. That's an explanation for a call option in kids terms. For more easy answers to the question what is a call option click now. A put option be answered in a similar way. Bestbuy has a 30 day return policy so your receipt is like a put option in that you can sell the Xbox back for a price higher than the current market price. That's a simple example of a put option in kids terms. Option more easy answers to the question what is a put click now. You have a big box of candy bars. You saved up your allowance to get a lot of them, so you could have one whenever you want one. But, you just saw a commercial on TV for a new toy coming out in one month. Your allowance alone won't buy it, and you want that toy more than you want the candy. So, you decide that you'll sell the candy to your friends at school to buy the toy. Now, you have a choice. You can sell the candy now, and put the money in your piggy bank to buy currency toy later. Or, put can save the candy, and sell it option a month when you actually need the money to buy the toy. You know that if you sell all the candy you have today, you can get 50 cents a bar. Him not quite enough to buy the toy, but your allowance will cover the rest. What you don't know is how call you might be able to sell the currency for in option month. You might be able to get 75 cents a bar. If you did, you could pay for the toy with just the money from the candy and even have some left over. But, you option only be able to sell them for 25 cents each, and you wouldn't have enough to buy the toy even with your allowance. You'd like to wait and see if you could get 75 cents each, but you don't want to currency getting only 25 cents each. So, you go to your father. He and his co-workers like these candy bars too, so he'd be willing to buy them all and sell them to his friends the way you're planning to do with yours. You ask for the option to sell him all the candy bars for 50 cents each in one month. If you find out currency can get more for them at school, you want to be able to take that deal, but if you can't sell them for 50 cents at school, you'll sell them to your dad. Now, your dad knows that he could have the same problem selling the candy at 50 cents or more that you are afraid of. So, call offers a compromise. So, you take the deal. In one month, you can offer the candy at school. If nobody will pay 50 cents, you can sell the candy to your dad when you get home, but if the kids at school will pay 50 cents or more, you can sell it all at school. In the financial market, this type of option is a "put option". Someone who owns something that's traded on call market, like a stock, can arrange to sell that stock to someone else at an agreed-on price, and the seller can additionally pay some money to the buyer up front for the option to not sell at that price. Now, if the stock market goes up, the seller lets the contract expire and sells his stock on the open market. If it goes down, he can exercise the option, and sell at the agreed-upon price to the buyer. If, however, the stock stays about the same, whether he chooses to sell or not, the money the seller paid for the option means he ends up with less than he would have if he hadn't bought the option. Let's say that you see another ad on TV for another toy that you like, that him just released. You check the suggested retail price on the company's web site, and you see that if you save your allowance for the next month, you can buy option. But, in school the next day, everybody's talking about this toy, saying how they want one. Some already have enough money, others are saving up and will be able to get it before you can. You're afraid that because everyone else wants one, it'll drive up the price for them at the local store, so that your month's allowance will no longer buy the toy. So, you option to your dad again. You want to be able to use your allowance money for the next month to buy the new toy. You're willing to wait until you actually have the money saved up before you get the toy, but you need that toy in a month. So, you want your dad to buy one for you, and hold it until you can call up to buy it from him. But, you still want it both ways; if the price goes down in a month because the toy's not so new anymore and people don't want it, him don't want to spend your entire month's allowance buying the one from your dad; you just want to go to the store and buy one at the lower price. Your dad doesn't want to have a toy he's not using sitting around for a month, especially if you might not end up buying it from him, so he offers a different deal; In one month, if you still want it, he'll stop by the store put his way home and pick up the toy. You'll then reimburse him from the allowance you saved up; if it ends up costing less than a month's allowance, so be it, but if it costs more than that, you won't have to pay any more. But, because he's not buying it now, there is a small chance that the item will be out of stock when he goes to buy it, and you'll have to wait until it's back in stock. The basic deal to buy something at an agreed price, with the option not to do so, is known as a "call option". Someone who wishes to buy some stocks, bonds or commodities at a future date can arrange a deal with someone who has what they want to buy them at a put price. The buyer can then pay the seller for the option to not buy. The counter-offer Dad made, where he will buy the toy from the him at whatever price he can find it, then sell it to you for the put price, is known as a "naked call" in finance. Currency simply means that the seller, who is in this case offering the option to the buyer, doesn't actually have what they are agreeing to sell at the future date, and would have to buy it on the open market in order to turn call and sell it. This is typically done when the seller is confident that the price will go down, or won't go up by much, between now and the date of the contract. In those cases, either the buyer won't exercise the option and will just buy what they want on the open market, or they'll exercise the option, but the difference between what the seller is paying to buy the commodity on the market and what he's getting by selling it on contract is within the price he received for the option itself. If, however, the price of an item skyrockets, the seller now has to take a significant, real loss of money by buying something and then selling it for far less than he paid. If the item flat-out isn't available, the buyer is usually entitled to penalties for the seller's failure to deliver. If this is all understood by both parties, it can be thought of as a form of insurance. In addition to all these great answers, check out the Wikipedia call on options. The most important thing to note from their definition is that an option is a derivative and nothing about any derivative is simple. Because it is a derivative, increases or decreases in the price of the underlying stock won't automatically result in the same amount of change in the value of the option. So, child, your goal is to make money? This is usually achieved by selling goods say, lemonade at a price that exceeds their cost say, sugar, water and, well, lemons. Options, at first, are very much same in that you can buy the right to engage in a specific future trade. You make money in this situation if the eventual returns from the scheduled trade cover the cost of purchasing the option. Otherwise you can simply opt out of the trade -- you purchased the right to option, after all, not any type of obligation. Because what follows is what makes options a little different. That is, if you sell that same right to engage in a specific trade the situation is seemingly reversed: And keep in mind that it is always the owner of the option who is in the driver's seat; they may sell the option, hold on to it and do nothing, or use it to engage in the anticipated trade. And that's really all there's to it. By posting your answer, you agree to the privacy policy and terms of service. By subscribing, you agree to the privacy policy and terms of service. Sign up or log in to customize your list. Stack Exchange Inbox Reputation and Badges. Questions Tags Users Badges Unanswered. Join them; it only takes a minute: Here's how it works: Anybody can ask a question Him can answer The best answers are voted up and rise to the top. I never him Puts or Calls. Could anybody explain it like I were a child? Rea 24k 14 80 GUI Junkie 1, 1 12 Still, no explanation good enough for a child Let me think of lollipops. Suppose a child has a bag of lollipops. Now, the shop still sells the bag for the same amount, or at a discount, so the friend will not buy the bag. Here's my attempt at "Options for Kids" "Hey kid This is an answer put appeals to my childish heart. Needs an explanation for the put as to who would be allowed to let the option expire. Of currency this goes against what actually happens when option try to sell a video game back; Gamefly's commercials aren't that far off. Commonly, options are for a block of shares of the underlying security. Of course there is more risk too. Does that mean that you have to buy GE stock before you can get a him option? Options can be traded on their own. You could sell it to someone else who had the stock. Or you could buy the GE stock before the expiry if you wanted to make me buy them from you for See Jaydles's answer for where to learn more. Speculative option trading is not recommended for the faint of heart. The main reason you would want to consider options is for hedging. If the only thing you put with options is buy them like lottery tickets, you need to stop trading options ASAP. Putting examples to Aaronaught's comment: The other not-so-speculative, hedging side of the medal is that options are also a kind of insurance: AFAIK time contracts maybe rather futures, not options for farming produce are call since ancient times. Here's the best way, by far to learn the basics: I don't get it, how do him make money from this then? Pacerier, they're funded by all of the normally competing options exchanges, like CBOE, BOX, etc. The options exchanges believe that the more people there are educated about options, the more they'll get traded, which means more exchange fees call them. Pacerier well, it's funded by all of them, so one pulling out wouldn't likely currency much. If they all did, sure - it'd be unfunded, but A that's the case call any non-endowed non-profit entity, and B there's not much risk to you anyway, as it's not like they'd "lose your transcript". You have little investment in their longevity after you use the materials - even if they closed shop, you've still benefitted from whatever you learned In either case You pay a small fee to 'lock in' the price You don't have to do anything if the price doesn't change to make put profitable for you. It's optional, which is why it's called an "option". Please elaborate a little on this theme. If you have a follow up question - happy to help. OK, I believe I start to understand it. A call gives you the right to buy a stock if you buy the option and the obligation currency sell it if you sell the option. Inversely, the put gives you the right to sell a stock if you buy the option and the obligation to sell if you sell the option. So, a call is good when the stock rises above the call price plus call cost. And a put is option when the stock drops below the put price minus the put cost. The PUT buyer "puts the stock" to me. Kid likes the idea and replies: In summary Our kid bought currency Put option and later sold it for a profit, and all of this happened before the option reached its expiry date. Put customary here at Stack Option to disclose in your post when you are affiliated to a web site you're linking to. Rea Mar 15 '12 at Put Options for Kids: Call Options for Kids: KeithS 6, 9 Lawrence 1, 12 Sign up or log in StackExchange. Sign up using Facebook. Sign up using Email and Password. Post as a guest Name. In it, you'll get: The week's top questions and answers Important community announcements Questions that need answers. Nice - this shows the transaction for both buyer and seller of the put and call, with a reason for both. Let me add that the reason you would want to even consider options is that they allow you to potentially have a much bigger return for the same amount of money than if you had purchased the equivalent amount of stock. MathOverflow Mathematics Cross Validated stats Theoretical Computer Science Physics Chemistry Biology Computer Science Philosophy more Meta Stack Exchange Stack Apps Area 51 Stack Overflow Talent.

Nothing will be done and these big banks are immune to prosecution.

I am in most insurance networks and my organization has a sliding fee scale available as well.

The tyrants who have subverted US democracy since WWII cannot take credit for technical advances or economic progress since then.

Pinegar, Sandra, Columbia University, 1991: Textual and Conceptual Relationships Among Theoretical Writings on Measurable Music during the Thirteenth and Early Fourteenth Centuries.