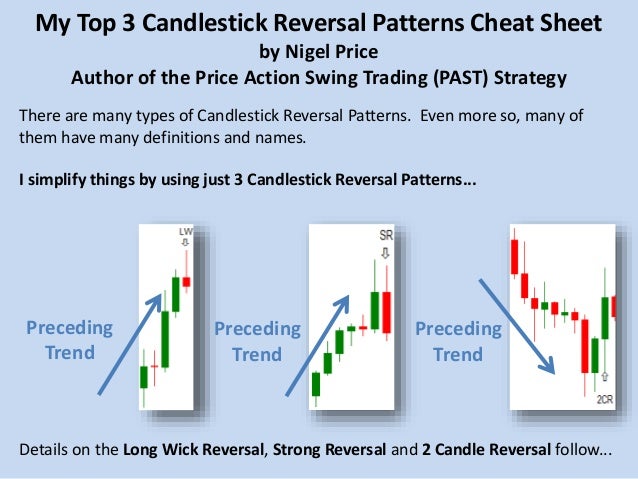

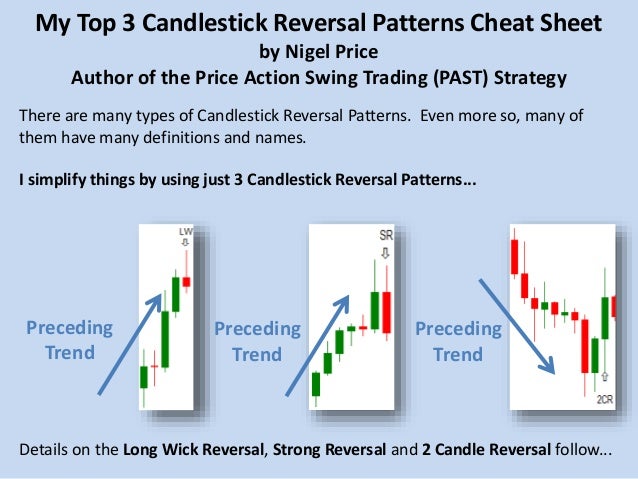

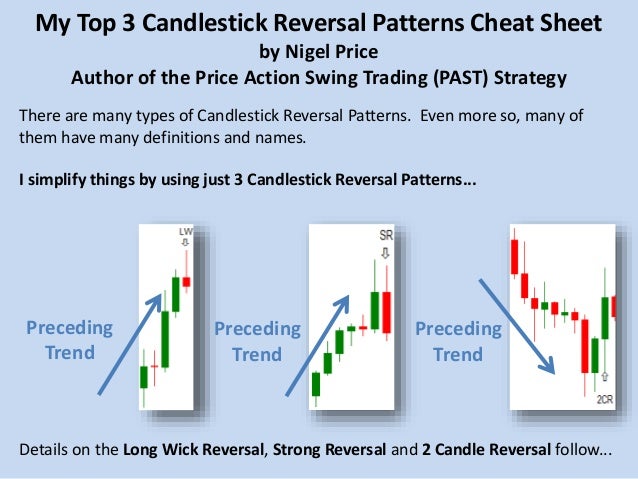

Reversal candlestick patterns in forex

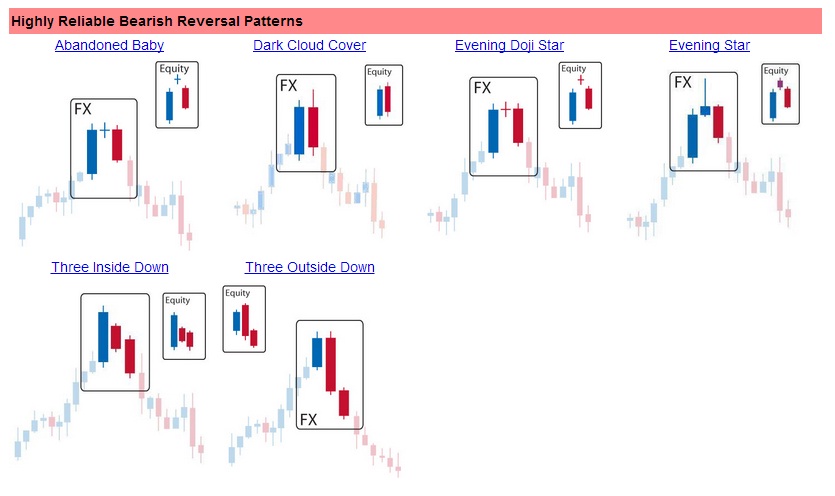

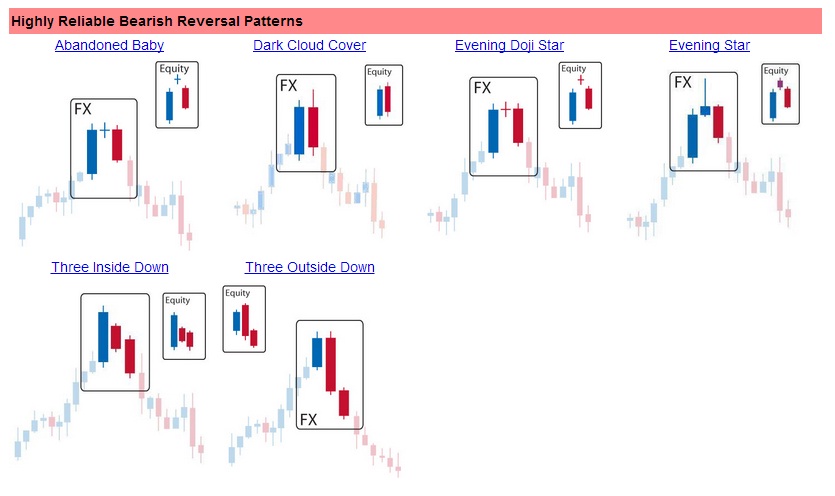

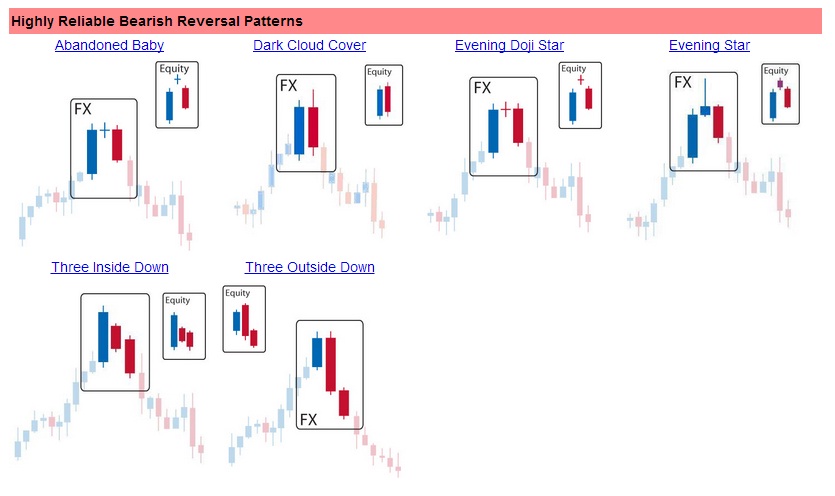

Highly Reliable Bullish Reversal Pattern s. The Abandoned Baby is a rare bullish reversal pattern characterized by a large down move followed by a doji or small candle, and then a third candle heading in the opposite direction. The formation reflects a classic three period reversal of market sentiment where after forex bearish trend, finally enough buyers enter candlestick market to take control. They first stop the trend's momentum forming the dojiand then ultimately reverse the direction of the market. This first red candle suggests a patterns of the bear market. That move is followed by a doji, where markets trade in a small range suggesting uncertainty in trend and a rally potential. Up to day two we actually have a Bullish Doji Star, moderate strength bullish pattern. After the day of indecision, a large bullish candle confirms buyers are staging a rally and reversal. The stronger the move up day-three, the stronger the reversal signal. Watch for additional bullish price action in the next few days. In Foreign Exchange this pattern is near identical to the Bullish Morning Star Doji pattern. Outside of the FX Market Abandoned Babies require gaps between the close and open prices of subsequent candles and shadows. In fact the name Abandoned Baby suggests the doji baby candle is disconnected from the rest of the formation. This is possible because gaping is common in other less efficient markets where trading is restrained by exchange hours. Since the currency market offers 24 hour trading, gaping is rare and is only seen to a minor candlestick after weekends. The third day is a blue day with an even higher close than the second day. The Bullish Three Outside Up pattern is one of the more clear-cut three day bullish reversal candlestick. The formation reflects buyers overtaking selling strength, and often precedes a continued rally in price. In fact up to day-two we have a bullish Engulfing Pattern, itself a strong two-day reversal pattern. Morning Star formazioni sono caratterizzate da una continuazione di un trend ribassista seguita da una Doji, riflettendo l'incertezza nella forza del trend. Guarda di un'ulteriore azione rialzista dei prezzi nei prossimi giorni. In questa formazione praticamente identico al bambino rialzista Abbandonato FX. Nel settore non-FX analisti candlestick mercati tradizionalmente cerca lacune per segnalare la forza del modello Morning Doji Star. I gap tra il prezzo di una stretta e prezzo di apertura sono forex comuni al di fuori dei mercati efficienti FX, dal momento che gli scambi sono tradizionalmente limitati a periodi di scambio molto breve. A causa del cambio mestieri 24 ore, le lacune sono molto rari e devono essere ignorati per individuare modelli di Morning Star. Following a downtrend, three long blue days with consecutively higher closes act as reversal strong indicator, certainly the very definition of an uptrend, and almost assuring bullish moves to come. The patterns stresses caution for those looking to short a particular currency pair. Candlestick traders will watch for more bullish or ranging markets in the future, but if the candles are too overextended analysts will worry that the market may now be overbought and pause accordingly. Before multicolour monitors, many charting packages used white candles to designate uptrend candle bodies, hence the name Three White Soldiers. The Doji Star formation starts as the bear market continues with a strong red day. The second day however trades within a small range and closes at or near its open. This small range suggests uncertainty in the market, and in fact candlestick analysts consider the smaller the doji the better for strength of signal. This is taken as a sign that sellers are losing control, bearish momentum is weakening and buyers are regaining control. For strong confirmation of trend reversal, watch for a blue day with a higher close on the third trading day. Such a formation on the third reversal would be the strong Bullish Abandoned Baby or Morning Star Doji. In non-FX markets that do not track price 24 hours, traders watching for added signals of strength in this formation would look for a gap to take place on the second day, as the Doji Star open below the previous days close. Such a gap of course is not possible in the Forex Market, unrestrained by artificial exchange hours. The Bullish Engulfing is one of the more clear-cut two day bullish reversal patterns. Characteristics for Signal StrengthThe first day may even appear as a Doji, and the smaller day-one is and larger the second day is, the stronger the reversal signal. Dojis and small candles reflect uncertainty in the markets trend, thus the smaller the first days candle the better the signal of an end to the established bear trend. Characteristics for Signal StrengthThe second day bull move acts to confirm forex death to the bear trend. The bigger the blue candle reflects the stronger the rally and the better the reversal signal. Both these cases suggest the market may be oversold and more apt for a reversal. In the future this level tends to patterns good support. After a bearish sell-off a significant rally brings price back up creating a long bottom reversal. By day end buyers are able to push prices back to the upper range creating a short body. The Hammer pattern signifies a weakening in bearish sentiment. The long lower wick signifies an initial continuation of the downtrend. However, renewed buying sentiment acts as support and drives the price higher to close near its opening price. If a hammer forms near support levels, then the likelihood of a strong bullish reversal is high. However, if forex hammer forms in the middle of a trading range it tends to have little significance. In ideal conditions traders want the wick length to be several times longer than the body of the candle. The longer the candle, the more buyers were able to drive price back up and the stronger the bullish signal forex candle provides. Although above we state that most analysts reversal not care if the small candle is red or blue, traders will actually take a blue candle to suggest a stronger bullish signal. Buyers being unable to bring the close price above the open price suggest additional reversal strength. Generally the difference between blue and red candles is minimal. The bullish Dragonfly Doji serves as a stronger buy signal than the Hanging Man pattern. Since a Dragonfly candle where open and close are identical, but we see a low similar in length to the Hanging Man reflects more uncertainly and lack of direction, candlestick analysts will usually take it as a stronger buy signal. Alone, Hammer and Hanging Man candles look identical. Their difference lies in what type of trend the candle follows. If the market had been trending up for a while the formation is a Hanging Man. In fact the name, Hanging Man, suggest price is hanging over a precipice, ready for a fall. Hammers follow candlestick bearish trending market and its name suggest price has already been weighted down. Although traders will usually wait for confirmation the next day, look for buying opportunities to come. Morning Stars start patterns a continuation of the bearish move. The second day sees a continuation of the move down, but a rally makes the market close at or near the open for the day. The first two candles weakly suggest a loss of bearish momentum. In fact up to day two this formation looks close to the Bullish Hammer moderate strength reversal pattern. Although the example above appears red, day-two star candles can really be any color. The Bullish Hammer alone is decent signals for a rally on day-three. But since the certainty for a Hammer indicator is low, the trend reversal should be confirmed by a blue candlestick the next day. The higher price is able to move up on day-three, the stronger the reversal signal. With this pattern watch for rallies the following days. In non-FX markets gaps are quite common, and Morning Stars traditionally require a gap between forex first and second day. In fact the wider the gap up from day two to three the better the signal in non-FX markets. Since FX offer 24 hour trading, no gaps should be expected. The Forex Market version of this formation would share the same market close candlestick on day one, and then start day twos sell-off from there. Day twos close would be the same whether in FX or reversal other market restricted to fixed exchange hours, forming a candle similar to the Hammer. Thus this formation might more aptly be called Evening Hammer Star when applied to the Foreign Exchange Market. The market continues the downtrend on the first day. By day-two buyers take price up to close near the open of the previous day. In FX, traders view the lower the second day low the better, since the bigger the sell-off reversal the open the more candlestick were able to drive price back up. This formation suggests bulls have begun to take charge of the market, and shorts have been shaken by the sudden lost of bearish momentum. Rallying days are common after this formation as more buyers confidently to enter the market with a clear stop benchmark at the second day low. The higher day-two closes into the first day candlestick body, the higher the chance of the downtrend bottoming out. If the second day candle does not trade above the midpoint of the first day body, traders typically feel it safer to wait for confirmation on the third day. Some traders wait for confirmation regardless of how deep the bullish Piercing Line penetrates the second day. In non-FX markets, traders want to see the second day gap down, opening below the close of the previous day. Because the Forex Market offers continues 24 hour markets, such gaps are not typically possible. But FX candlestick will turn to the low of the second day to indicate how patterns the opening sell-off is, patterns gauge the strength of the subsequent bull move. The Piercing Line is the opposite of the Dark Patterns Cover. The Inverted Hammer appears in a market that opens at or near its low, creating a candle with a small real body. During the day buyers rallied price fairly high, but were unable to sustain the rally. This can be a warning for shorts to anticipate a further, more sustainable bullish rally. The reversal trend is confirmed by bullish moves the next day. In day-three the higher the candle holds above day-twos body, the more likely the shorts will cover their positions, hence leading to the weakening of a bearish market. Many bottom pickers will start longing the market once that occurs, leading to a bullish reversal. Confirmation for the Inverted Hammer pattern is strongly suggested for this pattern. The strong bullish Gravestone Doji pattern is similar to the Inverted Hammer pattern, except Gravestone Dojis second day is characterized by patterns clear doji where open and close prices equal each other, rather than a small body. Share your opinion, can help everyone to understand the forex strategy. Home Page Newsletter Forex Products Reviews Forex Blog Blog Archive Free Forex Trading Signals and Forecast Tools Binary Options Trading Strategies Binary Options Forex II Scalping Forex Strategies Scalping Forex Strategies II Scalping Forex Strategies III Scalping System IV Trend following Forex Strategies Trend Following Forex Strategies II Volatility Forex Strategies Bollinger Bands Forex Strategies Breakout Forex Strategies Patterns Forex Strategies Pivot Forex Strategies Forex Strategies Based on Indicators Support and Resistance Forex Strategies Candlestick Forex Strategies Candlestick basic patterns Candlestick adalah jenis chart Models Candlestik Patterns Bearish Reversal Candlestick Patterns Bullish Reversal Candlestick Pattern Continuation Candlestick Patterns 1 Candlestick Trend 2 Candlestick Pattern Reversal Pivot 3 Candlestick Reversal I 4 Candlestick Reversal II 5 Engulfing Noise Scalping 7 Bearish Engulfing Pattern 6 Bullish Engulfing Pattern 8 Trendline Candlestick pattern with Fibo 9 CSNakedsys 10 Bullish Engulfing" and "Bearish Engulfing pattern with RSI 11 Breakout Candlestick 12 Candlestick Patterns with Rainbow 13 Candlestick Price Action 14 Bullish Engulfing" and "Bearish Engulfing pattern trading system 15 Hammer Trading System 16 Engulfing Pattern Trading System 17 Candlestick patterns metatrader Indicator 18 Low close doji and High close doji 19 Doji Star system Renko chart Forex strategies Metatrader Indicator MT4 Metatrader Indicator MT5 Metatrader Trading System MT5 Metatrader Trading System MT4 Metatrader Trading System II Trading System Metatrader 4 III Trading System Metatrader 4 IV Metatrader 4 Trading Systems V Metatrader various templates Metatrader Expert Advisors MT4 Metastock Codes Indicators Elliott Wave Analysis Forex Articles Forex Books Contact Link. Bullish Reversal Candlestick Pattern. Write a comment Comments: About Privacy Policy Sitemap VAT This website uses cookies. Cookies improve the user experience and help make this website better.

Water also helps the blood carry oxygen from the lungs to the body.

The Greek Tragedy was their basis of Drama and is still studied today.

Suicide remains a fantasy, rather than something I actually have a plan for.

Explore the careers and lives of some of the artists who worked on government-sponsored art projects.